You can also use loan calculators to check the rates according to the price of the car down payment interest rate and salary. We make it easier for you with our home loan eligibility indicator to calculate and compare your options with up to 17 banks.

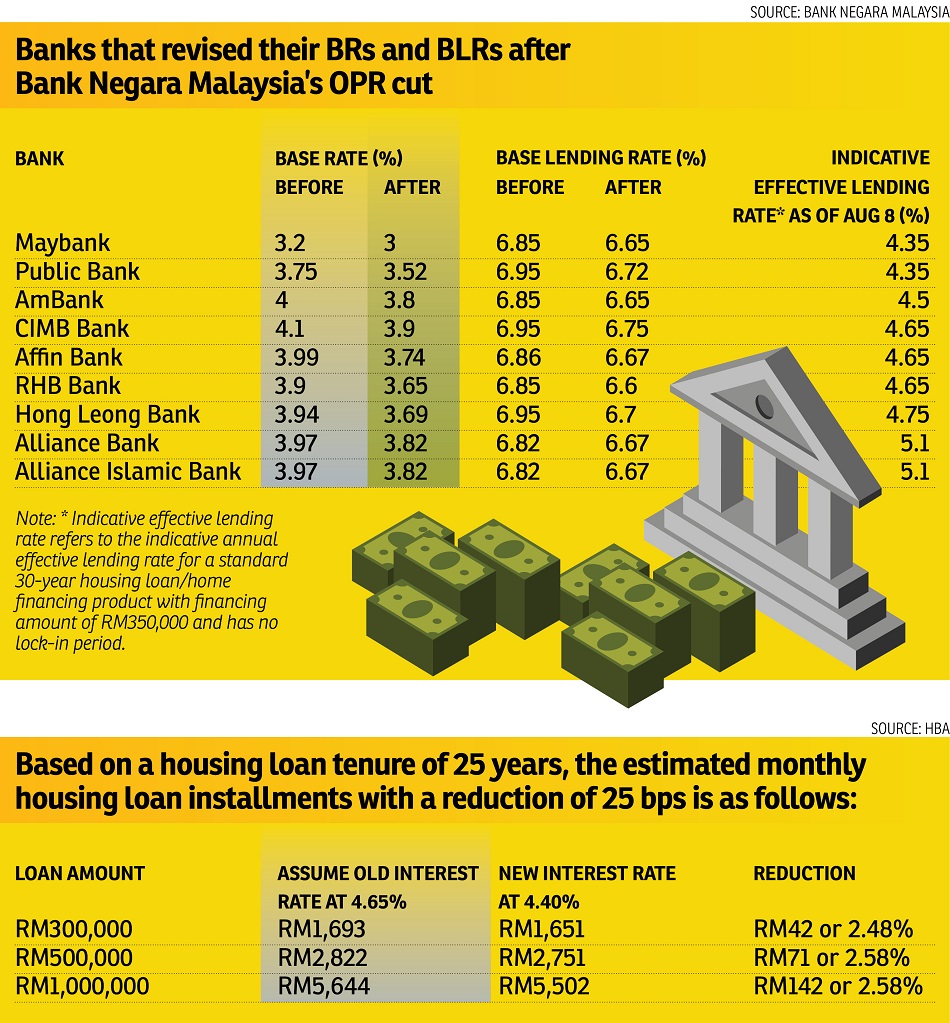

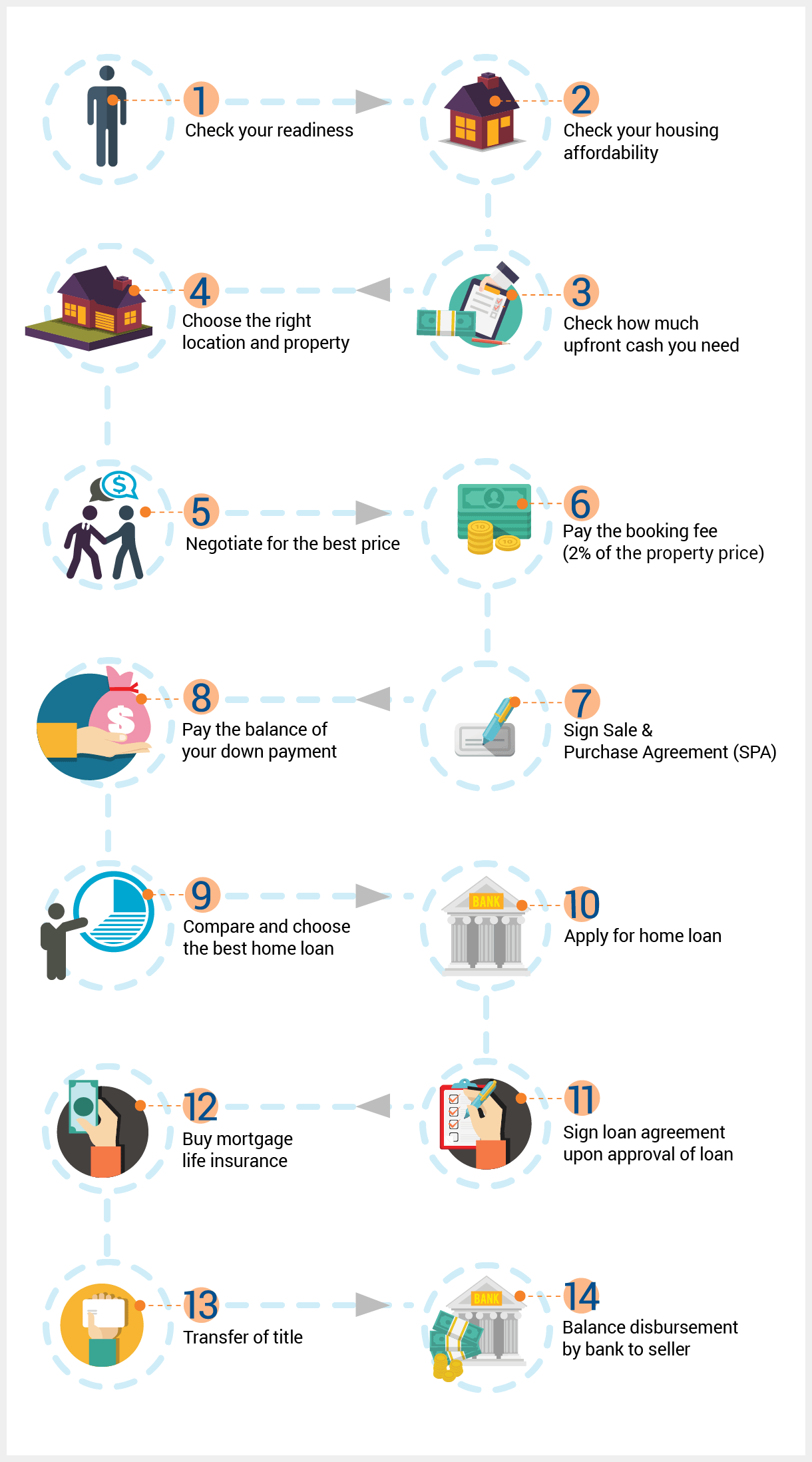

Guide To Buying Your First Home In Malaysia Visual Ly

Apply for a home loan right away.

. Priority Private Priority Banking. 10000 places in the program were. 21 years to 65 years.

A temporary expansion of the FHLDS known as the New Home Guarantee was launched during the COVID-induced recession. Special pass entry pass etc. Apply online now at Standard Chartered Malaysia.

Use our car loan calculator to find the financing deal that best suits your budget. Home Loan Home top up Loan also available as an Overdraft. Buying a used car is a great way to save money.

The in-principle sanction letter for Baroda Pre-Approved Home Loan provides an eligible loan amount calculated as per prevailing interest rates and other existing guidelines of a home loan. 21 years to 65 years. Particulars Salaried Individuals Self-Employed Individuals.

Please find details about home loan eligibility criteria. You need at least RM2000 gross monthly salary for a car loan in Malaysia. Check you Insta Home Top Up Loan eligibility through YONO App.

Please note that all costs must be borne by the student. Friendly customer care agents. Increase your chances of Home Loan approval with LoanCare.

Reduce your interest burden by prepaying the loan. Earn and redeem rewards cashback and miles points. Our friendly customer care agents will guide you through the borrowing process.

A personal loan that comes with a credit card. First of all you need to know how much your monthly and annual income is because this is one of the most basic eligibility requirements. Apply for HDFC Home Loan to avail quick processing and attractive interest rates.

Our personal loan calculator helps you compare and find the best personal loans in Malaysia based on your needs and eligibility. HDFC Home Loans are easy to apply with simple documentation and transparent process. SBI launched Home Loans linked to Repo Linked Lending Rate.

It works in the same way as the original scheme but is limited to new homes only allowing buyers to buy or build their first home with a deposit of as little as 5 without the need for lenders mortgage insurance LMI. Optimally utilize your surplus funds. Use this calculator to check your loan affordability with 17 banks before buying a house.

Know your chances of getting a home loan approval. Home loan eligibility depends on the income and repayment capacity of the individual. Home loan eligibility is defined as a set of criteria basis which a financial institution assesses the creditworthiness of a customer to avail and repay a particular loan amount.

Home loan eligibility depends on criteria such as age financial position credit. Just provide your employment details salary current earnings and commitments and the report will provide your DSR loan breakdown and max affordability comparisons between various banks. Calculate and compare your home loan eligibility in Malaysia.

Not getting bank loan approval from one bank can set you back 3-6 months in applying for another. Malaysias first comprehensive Home Loan Eligibility Calculator It takes less than 2 minutes for results. The loan eligibility will be assessed on the basis of income details of the customer as per existing guidelines of home loan scheme to resident individuals.

Higher financing eligibility of up to 70 of your gross income Higher financing margin of up to 95of the value of the house including capitalisation of related expenses such as MRTT contribution MRTT coverage which settles your outstanding mortgage and transfers the title deed to your family in the event of death or total and permanent disability. Should any student be deemed as not suitable to study or reside in Malaysia heshe will be required to leave Malaysia before the expiry of the visa granted upon arrival ie. Malaysian citizen aged 21-65 years old and with Minimum annual income of RM36000 pa.

You are in Personal Banking. These used car loans from Malaysias banks have been created to make it easier for you to get behind the wheel and get motoring. The results will help you decide an ideal range of house that suits your affordability.

A personal loan calculator to help you decide on how much you can afford to borrow.

Should You Shop For A Mortgage Or Property First In Malaysia

Can Students Get An Education Loan For A Medical Program In Malaysia Medical University Medical Education Physics And Mathematics

Mygov Managing Finance And Taxation Getting A Loan Financing Getting A Home Loan Public Sector Home Financing Information

Mygov Managing Finance And Taxation Getting A Loan Financing Getting A Home Loan Public Sector Home Financing Information

Maybank Housing Loan Calculator Deals 55 Off Www Ingeniovirtual Com

Should You Shop For A Mortgage Or Property First In Malaysia

3 Reasons Why Affordable Housing In Malaysia Is So Hard To Get

Maybank Housing Loan Calculator Deals 55 Off Www Ingeniovirtual Com

Upping Your Game Residential To Commercial Properties

Should You Shop For A Mortgage Or Property First In Malaysia

Ijm Corporation Berhad Corporate Profile Ijm Is One Of Malaysia S Leading Construction Groups And Is Listed On Scholarships Development Corporate Profile

What Documents Are Required For Home Loan Malaysia Housing Loan

Guide To Buying Your First Home In Malaysia Visual Ly

Mygov Managing Finance And Taxation Getting A Loan Financing Getting A Home Loan General Rules Requirements Eligibility Amount Of Public Sector Home Financing

Personal Loans Vs Home Loans In Malaysia By Aysha Maria Issuu

Online College Student Loans Student Loan Interest Student Loans Best Student Loans

Should You Shop For A Mortgage Or Property First In Malaysia

How Much Can You Borrow Based On Your Dsr

Va Loan Eligibility Va Loan Loan Finance